Exosens announces the success of its Initial Public Offering on Euronext Paris

PRESS RELEASE

MÉRIGNAC, FRANCE – 7 JUNE 2024

Exosens is delighted with the success of its initial public offering (“IPO”). Consisting of a private placement to institutional investors, the IPO benefited from strong support from top-tier investors, in France and abroad.

The main purpose of the IPO is to enable the Group to reduce its debt in order to increase its financial flexibility and to support its development and growth strategy.

The Offering included:

- The sale of 8,500,000 existing shares, representing €170 million, by HLD Europe, Invest Prince Henri and Invest Gamma and certain minority shareholders of the Company.

- The issuance of 6,714,741 new shares, representing approximately €134 million.

- The issuance of 2,285,260 new shares reserved for Bpifrance Participations, representing approximately €46 million.

This represented a total amount of approximately €350 million, which may be increased up to approximately €402.5 million in case of full exercise of the over-allotment option.

Certain investors (CDC Tech Premium, Janus Henderson UK Limited, WCM Investment Management, LLC) have undertaken to place orders for a total amount of €87 million, and to purchase or subscribe for the Offered Shares allocated to them at the Offering Price.

Offering price set at €20.00 per share (the “Offering Price”), corresponding to a market capitalization of approximately €1.016 billion.

Trading of the shares on the regulated market of Euronext Paris on a when-issued basis is expected to start on June 7, 2024 under the ticker symbol “Exosens Promesses” until and including the settlement date of the Offering.

Commencement of trading of the Company’s shares on Euronext under the ticker symbol “EXENS” from June 12, 2024.

Settlement and delivery of the shares is expected to occur on June 11, 2024.

Following the IPO, Exosens will continue to be controlled by Groupe HLD.

The end of the stabilization period and the deadline for exercising the over-allotment option is July 5, 2024.

Exosens SA ("Exosens" and the "Group"), a high-technology company specialising in the supply of critical technological components for amplification, detection and imaging, today announces the success of its IPO on the regulated market of Euronext Paris (Compartment A) (“Euronext Paris”), (ISIN code FR001400Q9V2, ticker symbol “EXENS”).

The IPO, consisting of a private placement to institutional investors, generated strong interest from top-tier investors, in France and abroad. These included CDC Tech Premium, Janus Henderson UK Limited, and WCM Investment Management, LLC, who acted as cornerstone investors and have agreed to purchase or subscribe for €30 million, €27 million and €30 million, respectively, of Offered Shares, representing an aggregate amount of €87 million.

The Offering included:

- The sale of 8,500,000 existing shares, representing €170 million, by HLD Europe, Invest Prince Henri and Invest Gamma and certain minority shareholders of the Company.

- The issuance of 6,714,741 new shares, representing approximately €134 million.

- The issuance of 2,285,260 new shares reserved for Bpifrance Participations, representing

approximately €46 million.

This represented a total amount of approximately €350 million, which may be increased up to approximately €402.5 million in case of full exercise of the over-allotment option. Based on an Offering Price of €20.00 per share, Exosens’ market capitalization will amount to approximately €1.016 billion.

Jérôme Cerisier, CEO of Exosens, said: “I am delighted that Exosens’ IPO has been so well received by investors. Our listing on Euronext Paris marks a decisive step in our history. I am confident that this operation will allow us to benefit from greater flexibility to seize future growth opportunities and continue our profitable and value-creating growth trajectory, in furtherance of our mission: offering high-end technologies for a safer world.”

Jean-Hubert Vial, partner at Groupe HLD, said: “The listing of Exosens is a recognition of the Group’s tremendous development that HLD has been supporting since 2021, and it provides support for the continuation and amplification of the growth strategy. By remaining the majority shareholder of Exosens, HLD demonstrates its confidence and commitment to continue supporting Exosens and its management within a strengthened governance framework.”

Reason for the Offer

The main purpose of the Company's IPO is to enable the Group to reduce its debt in order to increase its financial flexibility, and to support its development and growth strategy. The private placement will also provide liquidity for the Selling Shareholders.

Price of the Private Placement

The Offering Price of the private placement was set at €20.00 per share (the “Offering Price”). This implies a market capitalization of Exosens of approximately €1.016 billion post-Offering.

Offering:

The Offered Shares distributed in the private placement included:

- 8,500,000 existing shares, representing €170 million, sold by (i) HLD Europe, Invest Prince Henri and Invest Gamma (together, ‘HLD’), (ii) certain minority shareholders of the Company (the “Minority Shareholders” and, together with HLD, the “Selling Shareholders”) (the “Initial Sale Shares”), to which may be added a maximum of 2,625,002 existing shares (i.e. approximately €52.5 million) sold by HLD upon exercise in full of the Over-Allotment Option (as defined below) (the ”Additional Sale Shares”) (the Initial Sale Shares and the Additional Sale Shares together being referred to as the ”Sale Shares”) ; and

- the 6,714,741 new shares (together with the Sale Shares, the “Offered Shares”) to be issued as part of a capital increase without shareholders' preferential subscription rights by way of a public offer as referred to in article L.411-2, 1° of the French Monetary and Financial Code, representing approximately €134 million, including issue premium (corresponding to 6,714,741 new shares).

Subscription/option commitments:

As part of the Company's IPO, the Company and Bpifrance Participations (‘Bpifrance’) have entered into an investment agreement under which Bpifrance has undertaken, subject to certain conditions (in particular the settlement-delivery of the Offered Shares in the Private Placement) and on the terms set out in the agreement, to subscribe for new shares to be issued by the Company, so as to hold 4.50% of its post-IPO share capital. Bpifrance will subscribe to the new shares in the context of a capital increase reserved for it, at the price of the Private Placement, concomitantly with the settlement-delivery of the IPO, i.e. a number of 2,285,260 new shares representing approximately €46 million (the ‘Capital Increase Reserved for Bpifrance Participations’).

HLD has also granted Bpifrance a call option enabling it, under certain conditions and in accordance with the terms set out in such agreement, to complete its initial investment by acquiring existing Exosens shares from HLD during the period of 12 months following settlement-delivery of the IPO, and at the price of the Private Placement plus interest, up to a maximum total investment by Bpifrance (i.e. the amount of the subscription to the reserved capital increase and the price of any shares acquired from HLD) of €75 million.

In addition, certain investors have undertaken to place an order in the order book for Offered Shares, for a total amount of €87 million, and to purchase or subscribe for the Offered Shares allocated to them at the Offering Price:

- Under the terms of an investment agreement entered into with the Company, CDC Tech Premium (‘CDC Tech Premium’) has placed an order in the order book for an amount of €30 million and to acquire the Offered Shares allocated to it at the Offering Price. CDC Tech Premium is a SICAV of the Caisse des Dépôts Group, whose purpose is to support the IPOs of European technology companies.

- Under the terms of an investment agreement with the Company, Janus Henderson UK Limited (‘JHIUL’) has placed an order in the order book for an amount of €27 million and agreed to acquire the Offered Shares allocated to it at the Offering Price. JHIUL is a UK investment management company.

- Pursuant to an investment agreement with the Company, WCM Investment Management, LLC (‘WCM’) has placed an order in the order book for an amount of €30 million and agreed to acquire the Offered Shares allocated to it at the Offering Price. WCM is an investment management company.

Over-Allotment option:

HLD, Invest Prince Henri and Invest Gamma have granted to J.P. Morgan SE acting as Stabilising Manager, in the name and on behalf of the Banks (as defined below), an option to acquire a number of shares representing in aggregate a maximum of 15% of the aggregate number of New Shares and Initial Sale Shares, representing a maximum of 2,625,002 Additional Sales Shares (the ‘Over-Allotment Option’).

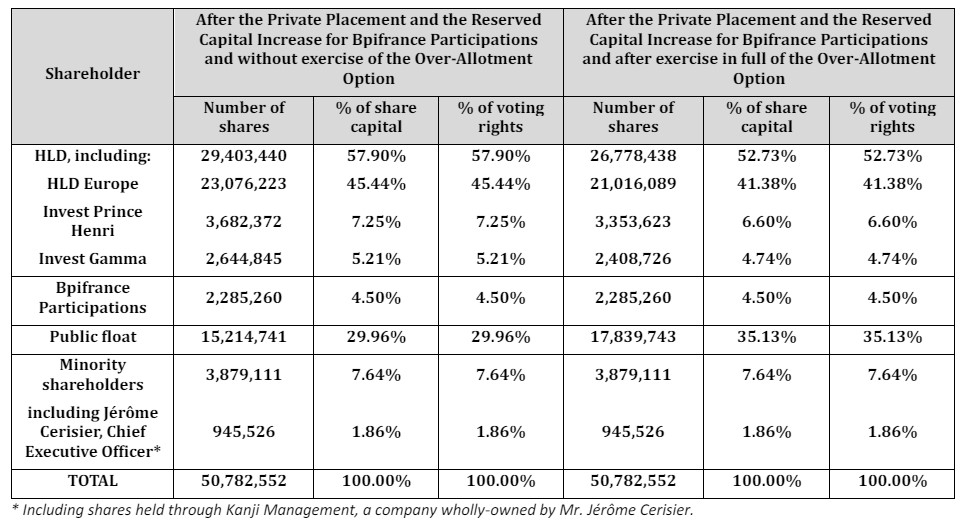

Evolution of the share capital:

Upon completion of the Offering, Exosens’ shareholding structure will be as follows:

Free float

Exosens’ free float will amount to approximately 29.96% of its share capital and will be increased up to approximately 35.13% of the share capital if the Over-Allotment option is exercised in full.

Lock-up undertakings

Lock-up undertaking of the Company: From the date of the underwriting agreement until 180 days after the settlement delivery date of the Global Offering, subject to certain customary exceptions.

Lock-up undertaking of HLD: From the date of the underwriting agreement until 180 days after the settlement delivery date of the Global Offering, subject to certain customary exceptions.

Lock-up undertakings of Bpifrance Participations: From the date of the underwriting agreement until 180 days after the settlement delivery date of the Global Offering, subject to certain customary exceptions.

Lock-up undertakings of Jérôme Cerisier, the Company's Chief Executive Officer, and Quynh Boi Demey, the Company's Chief Financial Officer: 365 calendar days after the settlement delivery date of the Global Offering, subject to certain customary exceptions.

Lock-up undertakings of certain minority shareholders who are members of the Group's Executive Committee (excluding Jérôme Cerisier, the Company's Chief Executive Officer, and Quynh Boi Demey, the Company's Chief Financial Officer), holding approximately 1.40% of the Company's post-IPO share capital: 365 calendar days after the settlement delivery date of the Global Offering, subject to certain customary exceptions and excluding a percentage of the signatory’s shareholding equal to the percentage of HLD’s shareholding represented by any shares it sells before the expiry of such 365-day period.

Lock-up undertakings of certain minority shareholders, holding approximately 3% of the Company’s post-IPO share capital: 365 calendar days after the settlement delivery date of the Global Offering, subject to certain customary exceptions.

Indicative timetable:

The trading of Exosens shares on a when-issued basis will commence on June 7, 2024 at 9:00 a.m. (Paris time) on Euronext Paris under the ticker symbol “Exosens Promesses”.

Settlement and delivery for the shares issued in the Offering is expected to occur on June 11, 2024.

As from June 12, 2024, the Exosens shares will start trading on the trading line “Exosens“ on the regulated market of Euronext Paris.

The over-allotment option may be exercised by the Stabilization Agent until July 5, 2024, the end of the stabilization period.

Offer Proceeds

The gross proceeds of the issue of the New Shares amounts to 180 million euros.

The expenses relating to the private placement and the admission to trading are estimated at approximately €11.4 million.

The net proceeds from the issue of the New Shares will be approximately €168.6 million.

The Company will not receive any proceeds from the sale of the Initial Sale Shares and the Additional Sale Shares.

Financial advisors and other advisors

BNP Paribas, Citigroup and J.P. Morgan are acting as Joint Global Coordinators and Crédit Agricole Corporate and Investment Bank, Natixis and Société Générale are acting as Joint Bookrunners (together, the “Banks”) in the IPO. Lazard is acting as independent financial advisor. White & Case LLP is acting as legal advisor to Exosens and Cleary Gottlieb Steen & Hamilton LLP is acting as legal advisor to the Banks.

Information available to the public

Copies of the Prospectus approved by the AMF on 31 May 2024 under number 24-188, consisting of (i) a registration document approved on 22 May 2024 under number I. 24-010, (ii) a supplement to the registration document approved on 31 May 2024 under number I. 24-011 and (iii) a securities note including a summary of the Prospectus, are available free of charge on request from the Group at the following address: Exosens, 18 Avenue Pythagore, 33700 Mérignac, France, as well as on the websites of the AMF (www.amf-france.org) and Exosens (https://www.exosens.com).

The Group draws the public's attention to the risk factors set out in chapter 3 of the registration document and in section 2 of the securities note. The realization of one or more of such risks may have a material adverse effect on the Group's activities, reputation, financial position, results or outlook, and on the trading price of Exosens’ shares

Download the press release - EN

Download the press release - FR

Press contact:

For Exosens

Brunswick group – exosens@brunswickgroup.com

Benoit Grange, + 33 6 14 45 09 26

Hugues Boëton, + 33 6 79 99 27 15

Laetitia Quignon, + 33 6 83 17 89 13

For Groupe HLD

DGM

Charles-Etienne Lebatard : +33 6 14 74 83 08

Etienne Gautier : +33 7 48 15 22 35

Christian d'Oléon : + 33 6 08 49 89 07

Disclaimer

This press release is not being made in and copies of it may not be distributed or sent, directly or indirectly, into the United States of America, Canada, Australia or Japan.

The distribution of this press release may be restricted by law in certain jurisdictions. Persons into whose possession this press release comes are required to inform themselves about and to observe any such restrictions. This press release is provided for information purposes only. It does not constitute and should not be deemed to constitute an offer to the public of securities, nor a solicitation of the public relating to an offer of any kind whatsoever in any country, including France. Potential investors are advised to read the prospectus before making an investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in the securities.

This press release is an advertisement and not a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, as amended (the “Prospectus Regulation”), also forming part of the domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”).

With respect to the member States of the European Economic Area and to the United Kingdom, no action has been undertaken or will be undertaken to make an offer to the public of the securities referred to herein requiring a publication of a prospectus in any relevant member State or the United Kingdom. As a result, the securities may not and will not be offered in any relevant member State or the United Kingdom except in accordance with the exemptions set forth in Article 1(4) of the Prospectus Regulation, also forming part of the domestic law in the United Kingdom by virtue of EUWA, or under any other circumstances which do not require the publication by Exosens of a prospectus pursuant to Article 3(2) of the Prospectus Regulation, also forming part of the domestic law in the United Kingdom by virtue of EUWA, and/or to applicable regulations of that relevant member State or the United Kingdom. In France, an offer to the public of securities may not be made except pursuant to a prospectus that has been approved by the French Financial Markets Authority (the “AMF”). The approval of the prospectus by the AMF should not be understood as an endorsement of the securities offered or admitted to trading on a regulated market.

This press release does not constitute an offer to purchase or to subscribe for securities in the United States or in any other jurisdiction.

The securities referred to herein may not be offered or sold in the United States of America absent registration or an applicable exemption from registration under the U.S. Securities Act of 1933, as amended. Exosens does not intend to register all or any portion of the offering of the securities in the United States of America or to conduct a public offering of the securities in the United States of America.

This press release does not constitute an offer of securities to the public in the United Kingdom. This communication is being distributed to and is directed only at (i) persons who are outside the United Kingdom or (ii) persons who are “qualified investors” within the meaning of Article 2 of the Prospectus Regulation as it forms part of domestic law by virtue of the EUWA and who are also (x) investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (y) high net worth entities, or other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “Relevant Persons”). Any investment activity to which this communication relates will only be available to and will only be engaged with, Relevant Persons. Any person who is not a Relevant Person should not act or rely on this press release or any of its contents.

J.P. Morgan SE, acting as Stabilization Agent, may, for a period of 30 days following the date of public disclosure of the offering price (i.e., until 5 July 2024 inclusive) (but not under any circumstances), in accordance with the applicable laws and regulations, in particular those of Delegated Regulation No 2016/1052 of the European Commission of March 8, 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament European Union and the Council and concerning the conditions applicable to buyback programs and stabilization measures, to carry out stabilization operations in order to stabilize or support the price of Exosens’ shares on the regulated market of Euronext Paris. In accordance with Article 7 of Delegated Regulation No 2016/1052 of the European Commission of March 8, 2016, stabilization operations may not be carried out at a price higher than the private placement price. Such interventions may affect the price of the shares and may result in the determination of a higher market price than would otherwise prevail. Even if stabilization operations were carried out, J.P. Morgan SE could, at any time, decide to discontinue such operations. The information will be provided to the competent market authorities and to the public in accordance with Article 6 of the abovementioned Regulation. Pursuant to the provisions of Article 8 of the abovementioned Regulation, J.P. Morgan SE, acting on behalf of the underwriters, may make over-allotments in connection with the private placement up to the number of shares covered by the over-allotment option, plus, if applicable, a number of shares representing 5% of the offer (excluding exercise of the over-allotment option).